OVERVIEW

The global market size of silicon carbide is expected to hit USD 1,850.1 million by 2025, rising at a CAGR of 19.35% during the peirod forecast. The key factors that drive this market’s growth are the growing demand for SiC devices in the power electronics industry and smaller devices that are enabled by the use of SiC-based devices.

TABLE OF CONTENT

1 Global Silicon Carbide Market

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

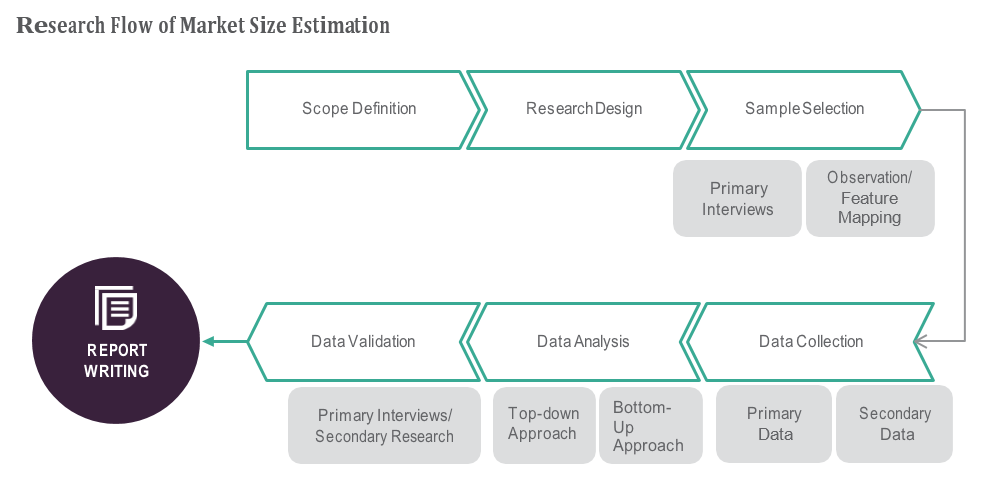

2 RESEARCH METHODOLOGY

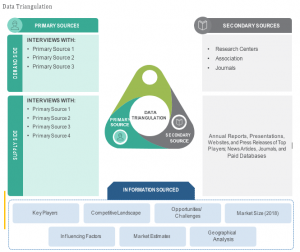

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

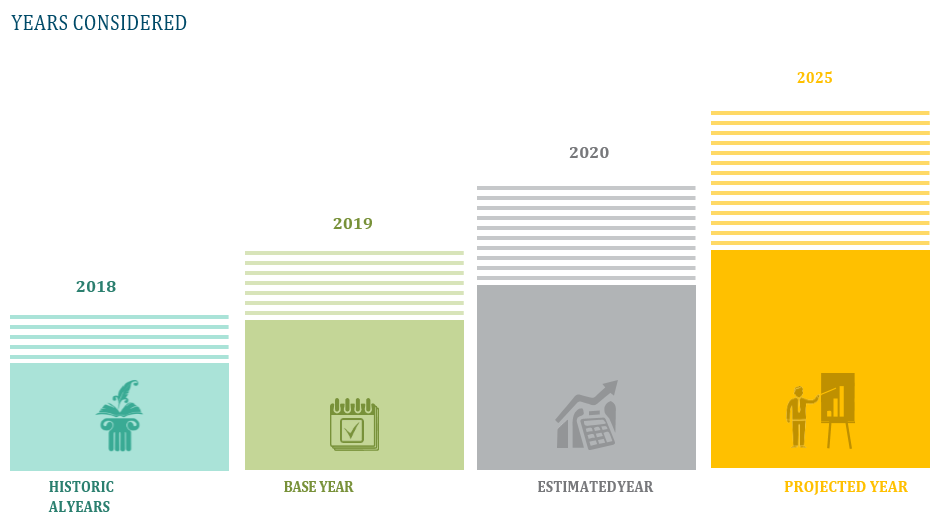

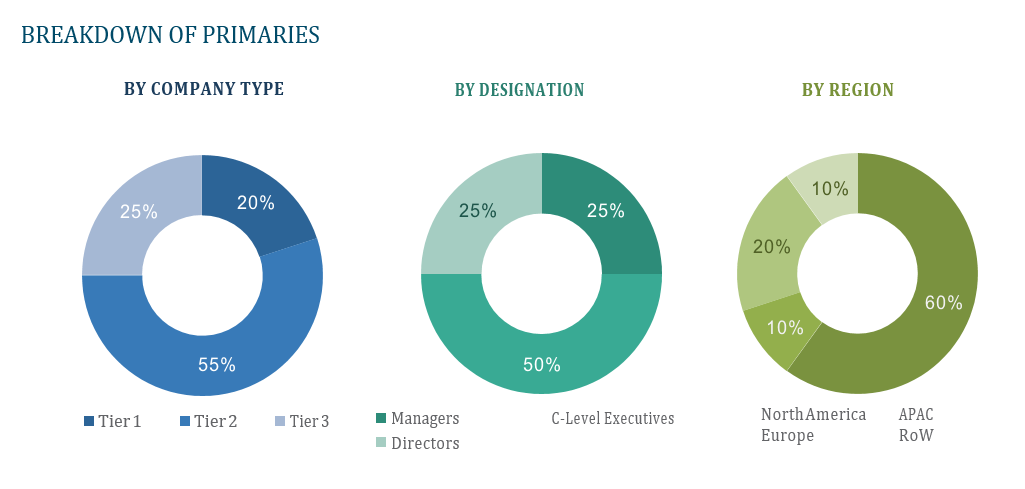

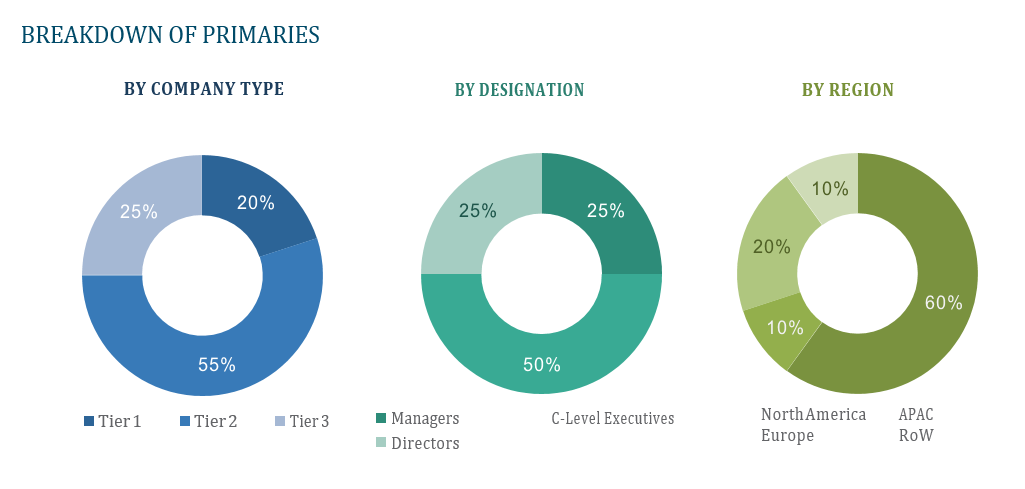

2.1.2.3 Breakdown of Primaries

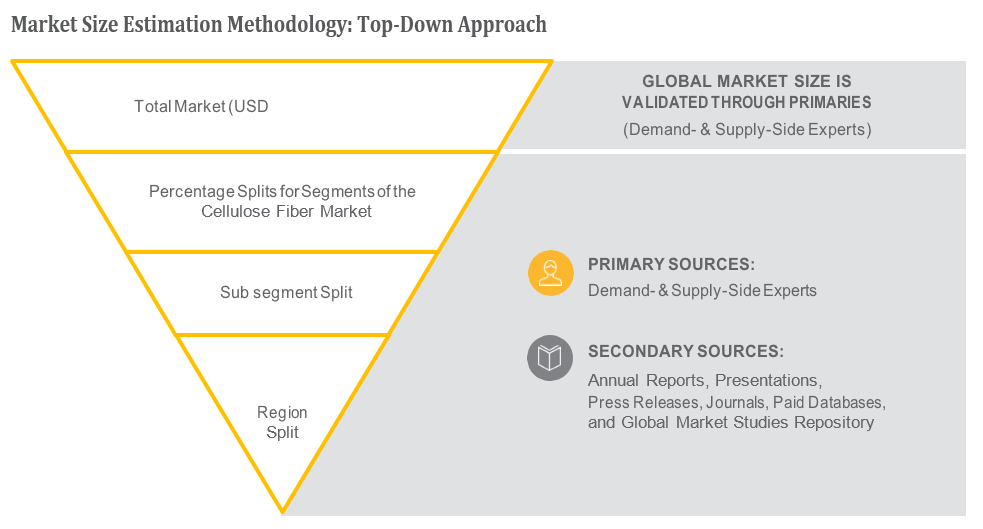

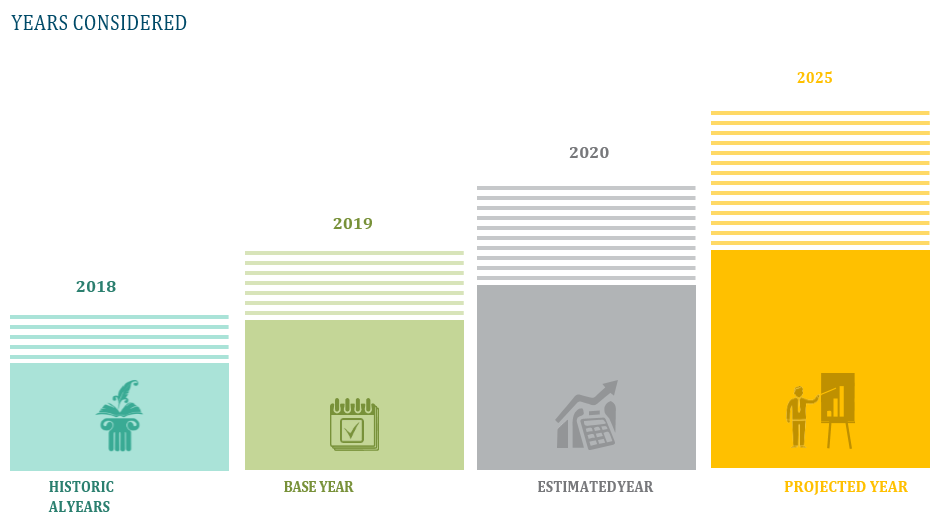

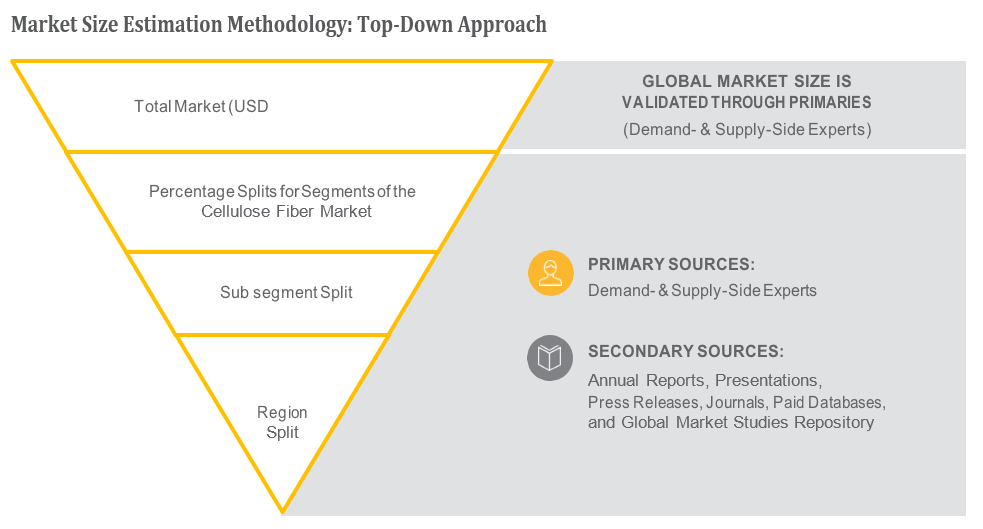

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

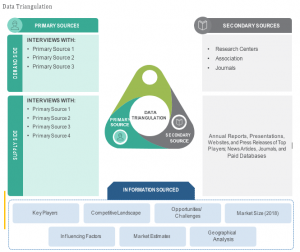

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Global Silicon Carbide Market – Executive Summary

3.1 Market Revenue, Market Size and Key Trends by Company

3.2 Key Trends by type of Application

3.3 Key Trends segmented by Geography

4 Global Silicon Carbide Market – Comparative Analysis

4.1 Product Benchmarking – Top 10 companies

4.2 Top 5 Financials Analysis

4.3 Market Value split by Top 10 companies

4.4 Patent Analysis – Top 10 companies

4.5 Pricing Analysis

5 Global Silicon Carbide Market – Industry Market Entry Scenario

5.1 Regulatory Framework Overview

5.2 New Business and Ease of Doing business index

5.3 Case studies of successful ventures

5.4 Customer Analysis – Top 10 companies

6 Global Silicon Carbide Market – Market Forces

6.1 Introduction

6.2 Market Dynamics

6.2.1 Drivers

6.2.2 Opportunities

6.2.3 Challenges

6.3 Porters Analysis of Market

6.3.1 Bargaining power of suppliers

6.3.2 Bargaining powers of customers

6.3.3 Threat of new entrants

6.3.4 Rivalry among existing players

6.3.5 Threat of substitutes

7 Global Silicon Carbide Market – Strategic Analysis

7.1 Value Chain analysis

7.2 Product Life Cycle

7.3 Supplier and distributor analysis (Market share and product dealing strategies)

8 Global Silicon Carbide Market – By Device (Market Size – & million/billion)

8.1 SIC Discrete Device

8.2 SIC Bare Die

9 Global Silicon Carbide Market – By Wafer Size

9.1 2 Inch

9.2 4 Inch

9.3 6 Inch and Above

10 Global Silicon Carbide Market – By Application

10.1 Power Grid Devices

10.2 Flexible AC Transmission Systems (FACTs)

10.3 RF Devices & Cellular Base Stations

10.4 Lighting Control Systems

10.5 High-Voltage, Direct Current Systems (HVCDs)

10.6 Power Supplies and Inverters

10.7 Industrial Motor Drives

10.8 Flame Detectors

10.9 EV Motor Drives

10.10 Others

11 Global Silicon Carbide Market – By Vertical

11.1 Energy & Power

11.2 Defense

11.3 Power Electronics

11.4 Automotive

11.5 Renewable Power Generation

11.6 Telecommunication

11.7 Others

12 Global Silicon Carbide Market – By Geography (Market Size – & million/billion)

12.1 Introduction

12.2 North America

12.2.1 US

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 U.K

12.3.2 Germany

12.3.3 Italy

12.3.4 France

12.3.5 Spain

12.3.6 Rest of Europe

12.4 Asia-Pacific

12.4.1 China

12.4.2 Japan

12.4.3 India

12.4.4 South Korea

12.4.5 Rest of APAC

12.5 Rest of the World

12.5.1 South America

12.5.2 Middle East

12.5.3 Africa

13 Global Silicon Carbide Market – Entropy

13.1 New product launches

13.2 M&A’s, collaborations, JVs and partnerships

14 Global Silicon Carbide Market Company Profile (Key Players)

14.1 Market Share, Company Revenue, Products, M&A, Developments

14.2 STMicroelectronics N.V.

14.3 Fuji Electric Co., Ltd.

14.4 Infineon Technologies AG

14.5 CREE, Inc.

14.6 Toshiba Corporation

14.7 Renesas Electronics Corporation

14.8 Microchip Technology Incorporated

14.9 ROHM Co., Ltd.

14.10 ON Semiconductor

14.11 General Electric Company

14.12 Company 11 & more

15 Global Silicon Carbide Market – Appendix

15.1 Sources

15.2 Abbreviations