OVERVIEW

The Global Automotive Cyber Security Market is calculated to reach $5.64 billion by 2024, at a CAGR of 24.47% during the forecast period 2019-2024. The market is majorly drive by the rising number of connected cars and electronic content per vehicle and reinforcement of mandates by regulatory bodies for vehicle data protection. Moreover, the increasing number of cloud-based applications in the automotive industry and technological advancements in the autonomous vehicle space can create new revenue generation opportunities for automotive cyber security manufacturers.

TABLE OF CONTENT

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

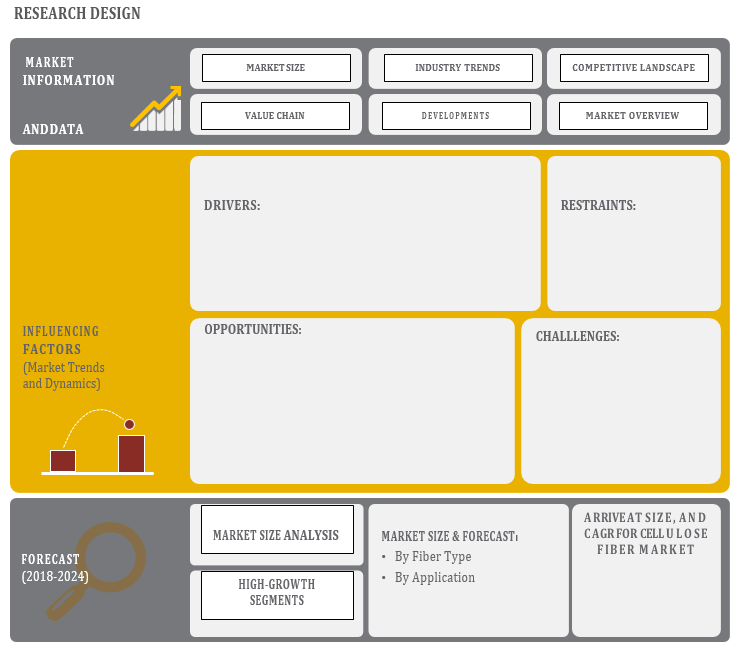

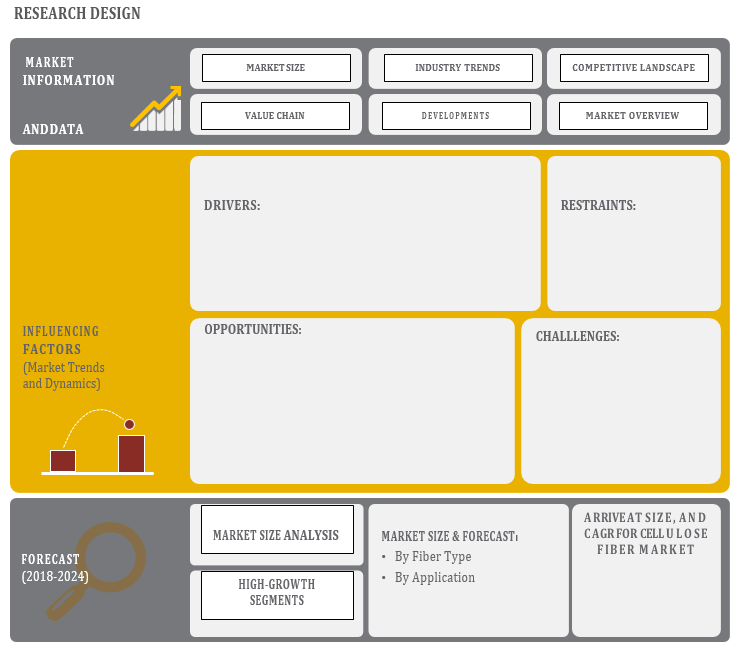

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 PRIMARY SOURCES

2.1.2.2 BREAKDOWN OF PRIMARIES

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.3 MARKET SHARE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

4.1 INTRODUCTION

4.2 MARKET DYNAMICS

4.2.1 DRIVERS

4.2.2 RESTRAINTS

4.2.3 OPPORTUNITIES

4.2.4 CHALLENGES

5 INDUSTRY TRENDS

5.1 INTRODUCTION

5.2 VALUE CHAIN

6 AUTOMOTIVE CYBERS ECURITY MARKET, BY SECURITY

6.1 INTRODUCTION

6.2 Endpoint Security

6.3 Application Security

6.4 Wireless Network Security

7 AUTOMOTIVE CYBER SECURITY MARKET, BY VEHICLE TYPE

7.1 INTRODUCTION

7.2 Passenger Car

7.3 Commercial Vehicle

7.4 Electric Vehicle

8 AUTOMOTIVE CYBER SECURITY MARKET, BY FORM

8.1 INTRODUCTION

8.2 In-Vehicle

8.3 External Cloud Services

9 AUTOMOTIVE CYBER SECURITY MARKET, BY APPLICATION

9.1 INTRODUCTION

9.2 Telematics System

9.3 Infotainment System

9.4 Powertrain System

9.5 Body Control & Comfort System

9.6 Communication System

9.7 ADAS & Safety System

10 GEOGRAPHIC ANALYSIS

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 UK

10.3.2 GERMANY

10.3.3 FRANCE

10.3.4 ITALY

10.3.5 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 JAPAN

10.4.3 SOUTH KOREA

10.4.4 INDIA

10.4.5 REST OF APAC

10.5 REST OF THE WORLD (ROW)

10.5.1 MIDDLE EAST

10.5.2 SOUTH AMERICA

10.5.3 AFRICA

11 MARKET ENTROPY

11.1 NEW PRODUCT LAUNCHES

11.2 M&A’s, COLLABORATIONS, JVs, AND PARTNERSHIPS

12 COMPANY PROFILES

12.1 INTRODUCTION

(Business overview, Products offered, Recent developments)*

12.2 KEY PLAYERS

12.2.1 Harman International

12.2.2 Symantec Corporation

12.2.3 Honeywell

12.2.4 NXP

12.2.5 Robert Bosch GmbH

12.2.6 Denso Corporation

12.2.7 Continental AG

12.2.8 Aptiv

12.2.9 Trillium Secure Inc.

12.2.10 Escrypt GmbH

12.2.11 Company 11 & More

*Details on Business overview, Products offered, Recent developments might not be captured in case of unlisted companies.

13 APPENDIX

13.1 SOURCES

13.2 ABBREVIATIONS