OVERVIEW

The overall market for diagnostic catheters is projected to hit USD 5,451 million by 2025, growing from 2020 to 2025 at a CAGR of 6.11%. Advances in medical imaging technology, an growing number of minimally invasive procedures, the introduction of new catheter design innovations and a growing geriatric population (a result of a resulting rise in the prevalence of chronic disorders) are projected primarily to drive growth in the global market.

TABLE OF CONTENT

1 Global Diagnostic Catheter Market

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

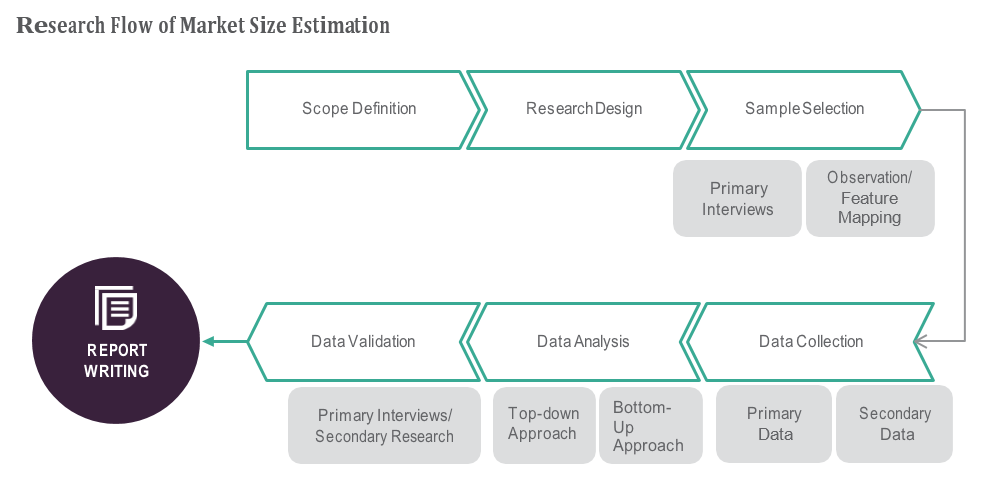

2 RESEARCH METHODOLOGY

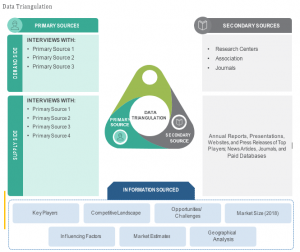

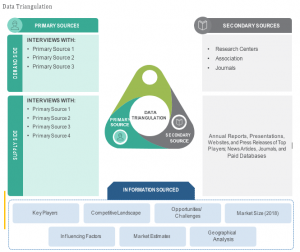

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

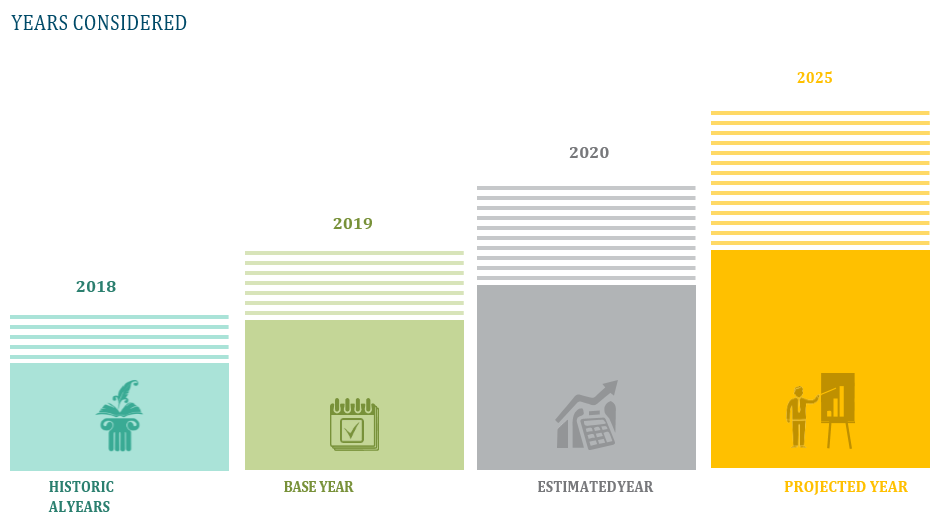

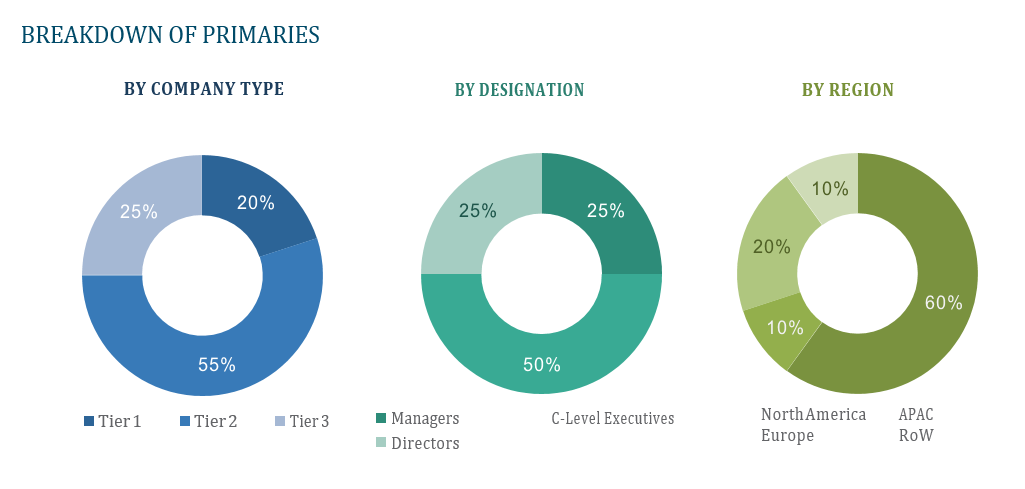

2.1.2.3 Breakdown of Primaries

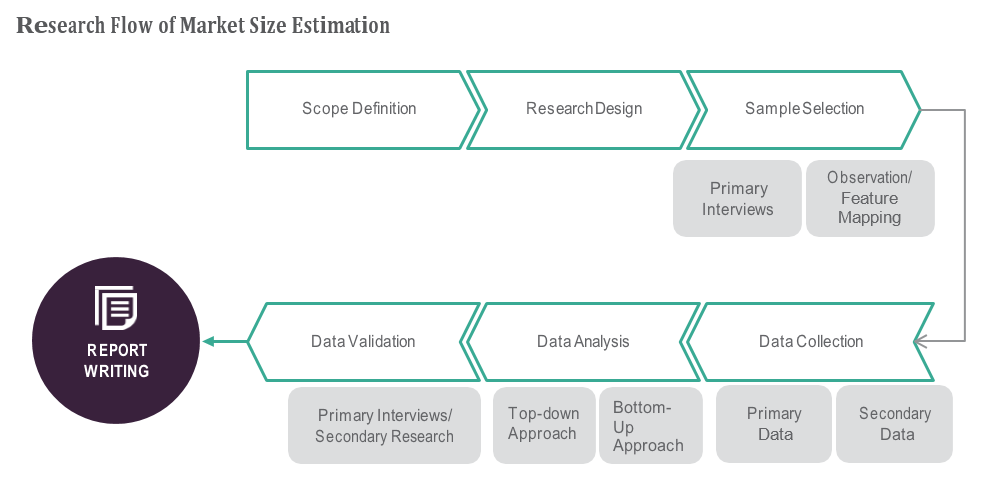

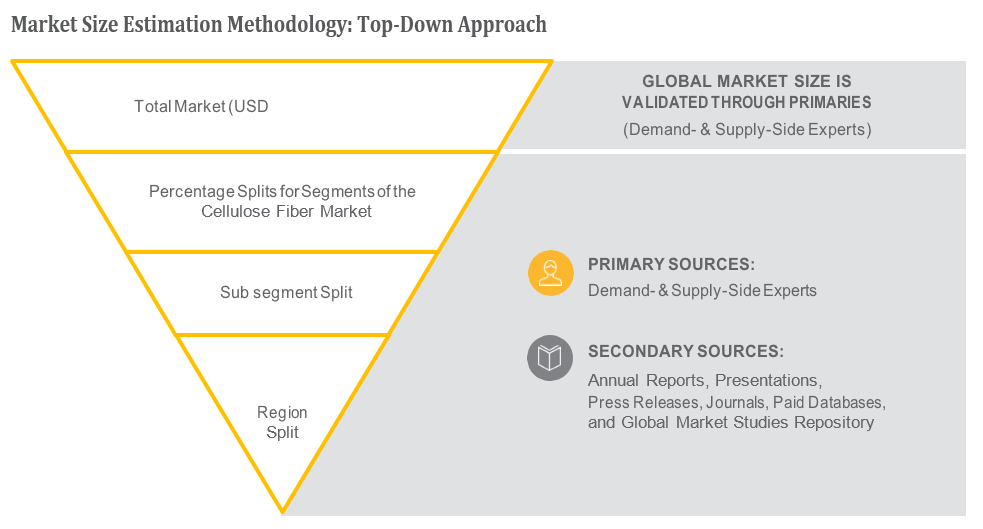

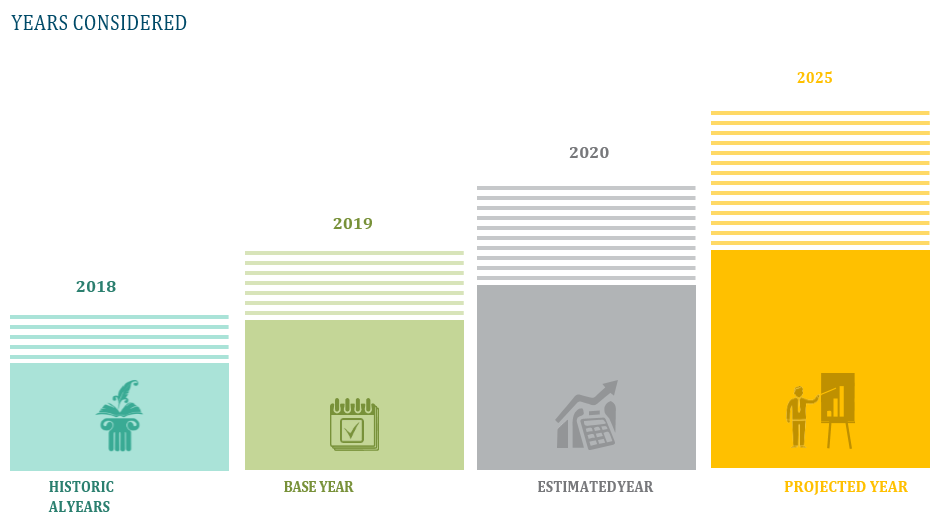

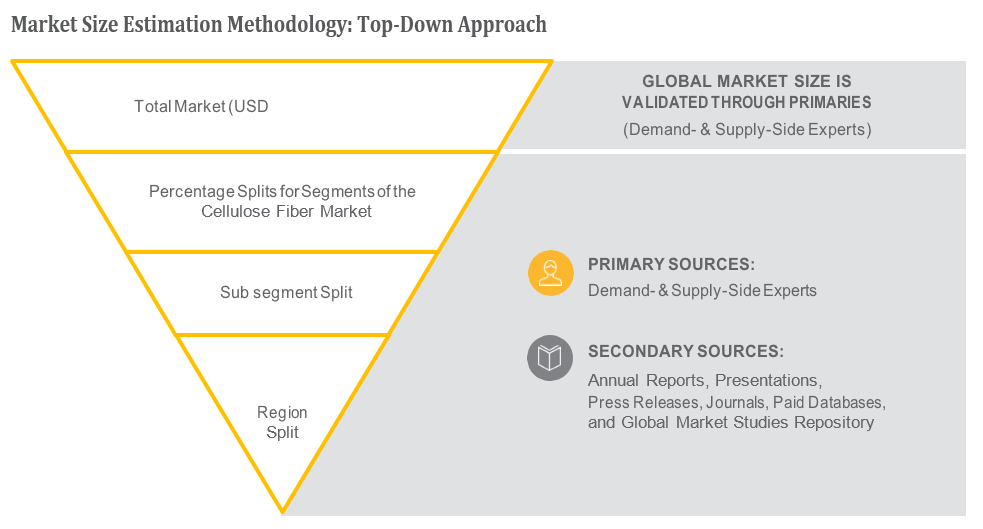

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Global Diagnostic Catheter Market – Executive Summary

3.1 Market Revenue, Market Size and Key Trends by Company

3.2 Key Trends by type of Application

3.3 Key Trends segmented by Geography

4 Global Diagnostic Catheter Market – Comparative Analysis

4.1 Product Benchmarking – Top 10 companies

4.2 Top 5 Financials Analysis

4.3 Market Value split by Top 10 companies

4.4 Patent Analysis – Top 10 companies

4.5 Pricing Analysis

5 Global Diagnostic Catheter Market – Industry Market Entry Scenario

5.1 Regulatory Framework Overview

5.2 New Business and Ease of Doing business index

5.3 Case studies of successful ventures

5.4 Customer Analysis – Top 10 companies

6 Global Diagnostic Catheter Market – Market Forces

6.1 Introduction

6.2 Market Dynamics

6.2.1 Drivers

6.2.2 Opportunities

6.2.3 Challenges

6.3 Porters Analysis of Market

6.3.1 Bargaining power of suppliers

6.3.2 Bargaining powers of customers

6.3.3 Threat of new entrants

6.3.4 Rivalry among existing players

6.3.5 Threat of substitutes

7 Global Diagnostic Catheter Market – Strategic Analysis

7.1 Value Chain analysis

7.2 Product Life Cycle

7.3 Supplier and distributor analysis (Market share and product dealing strategies)

8 Global Diagnostic Catheter Market – By Type (Market Size – & million/billion)

8.1 Diagnostic Imaging Catheters

8.2 Non-Imaging Diagnostic Catheter

8.3 Pressure and Hemodynamic Monitoring Catheters

8.4 Angiography Catheters

8.5 Electrophysiology Catheters

8.6 Temperature Monitoring Catheters

8.7 Others

9 Global Diagnostic Catheter Market – By Application Area

9.1 Cardiology

9.2 Urology

9.3 Gastroenterology

9.4 Neurology

9.5 Other

10 Global Diagnostic Catheter Market – By End-User

10.1 Hospitals

10.2 Diagnostic & Imaging Centers

11 Global Diagnostic Catheter Market – By Geography (Market Size – & million/billion)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 U.K

11.3.2 Germany

11.3.3 Italy

11.3.4 France

11.3.5 Spain

11.3.6 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 South Korea

11.4.5 Rest of APAC

11.5 Rest of the World

11.5.1 South America

11.5.2 Middle East

11.5.3 Africa

12 Global Diagnostic Catheter Market – Entropy

12.1 New product launches

12.2 M&A’s, collaborations, JVs and partnerships

13 Global Diagnostic Catheter Market Company Profile (Key Players)

13.1 Market Share, Company Revenue, Products, M&A, Developments

13.2 B. Braun Melsungen AG

13.3 Boston Scientific Corporation

13.4 Koninklijke Philips N.V.

13.5 St. Jude Medical, Inc.

13.6 Johnson & Johnson

13.7 Cardinal Health, Inc.

13.8 Terumo Corporation

13.9 Edwards Lifesciences Corporation

13.10 Medtronic PLC

13.11 C. R. Bard, Inc.

13.12 Company 11 & more

14 Global Diagnostic Catheter Market – Appendix

14.1 Sources

14.2 Abbreviations